Publikation

Australian public M&A deal trends report 2021

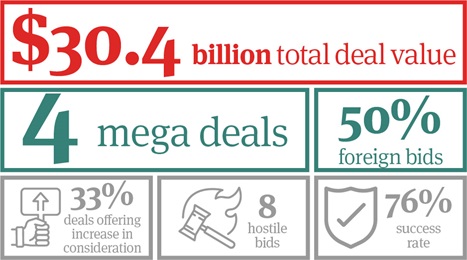

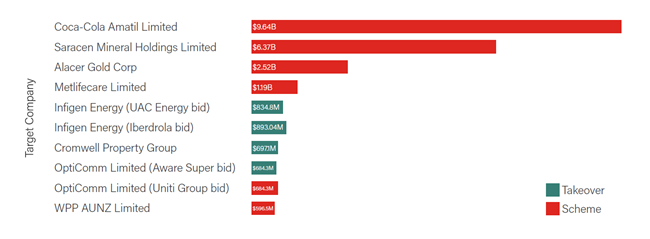

Our report considers how the Australian public M&A market has fared in 2021 during what has been a remarkable 12 months and attempts to forecast what we could be another vibrant year ahead.

Australien | Publikation | September 2021

Before anyone could understand the full extent of the impact of the COVID-19 pandemic on the global economy, the start of 2020 already forecast a year that was to be far from “normal”, with Brexit, the US election and other significant events set to determine dealmaker sentiment.

In our Australian Public M&A report 2020, we take a look at the year that was for Australian public M&A activity, 18 months on from the ASX’s “big drop” when global markets tumbled to lows not seen since the Great Recession of 2008. From 23 March 2020 onwards, deal making was (not surprisingly) sluggish, as the effects of the COVID-19 pandemic reached our local shores and both Commonwealth and State Governments implemented lockdowns and border closures.

We consider how the Australian public M&A market has fared during what has been a remarkable 12 months and attempt to forecast what the coming year may bring, as we see a steady return to deal maker confidence.

This report covers: |

|

|

|

Publikation

Our report considers how the Australian public M&A market has fared in 2021 during what has been a remarkable 12 months and attempts to forecast what we could be another vibrant year ahead.

Publikation

A comprehensive guide to Australian initial public offerings and listings on the Australian Securities Exchange.

Publikation

n a long-running dispute, taking in no less than three arbitrations spanning 26 years cumulatively (involving allegations of state interference in the arbitral process), the Court has provided useful guidance on the ss.67 and 68 challenges, particularly in the context of investor-state claims.

Subscribe and stay up to date with the latest legal news, information and events . . .

© Norton Rose Fulbright LLP 2023